Introduction

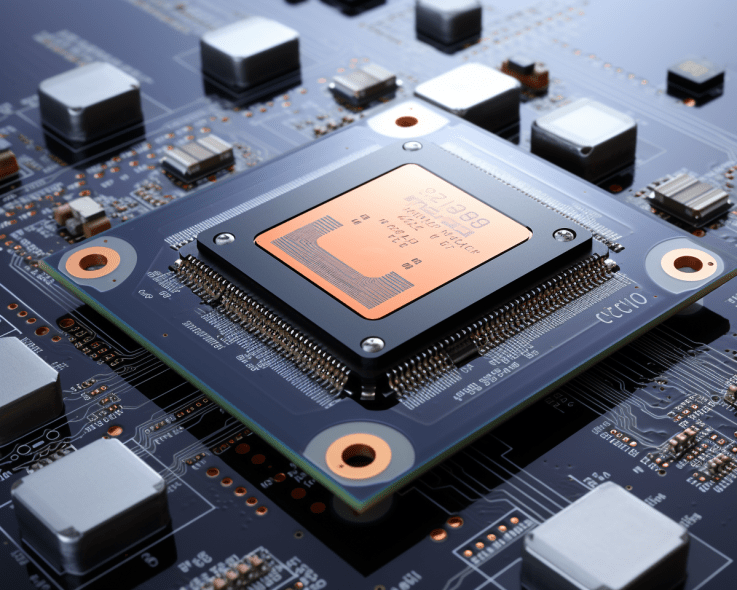

In the intricate realm of technology, the unsung heroes powering our everyday devices are often overlooked. Welcome to the world of semiconductors, or as they’re commonly known—microchips. These minuscule yet powerful components play a vital role in a myriad of electronic devices, ranging from televisions to smartphones, and even extending into healthcare, transportation, communications, and military systems.

Understanding Semiconductors

Before delving into the financial intricacies of Taiwan Semiconductor Manufacturing Company (TSMC), it’s essential to grasp the significance of semiconductors. These microchips, the heart and brains of our electronic devices, are pivotal in driving technological progress. Imagine them as the architects of the digital age, dictating the capabilities of our gadgets and influencing innovation across various industries.

The Competitive Landscape

The production of semiconductors is a fiercely competitive business, with top players shaping global technological progress. Some companies own their foundries and brandish chips with their company name, such as Intel (INTC), while others, like TSMC, specialize in custom-building chips for clients. TSMC, a giant you may have never heard of, stands as one of the industry leaders, influencing technological advancements on a global scale.

Founding History and Industry Overview

Founded in 1987 by industry visionary Morris Chang, TSMC took a bold step in revolutionizing semiconductor manufacturing. The company, headquartered in Hsinchu, Taiwan, played a crucial role in shifting the paradigm from in-house chip design and manufacturing to a dedicated foundry model. This shift allowed other companies to focus solely on chip design while entrusting TSMC with the manufacturing process.

Today, TSMC is a semiconductor powerhouse, producing over 12,300 products for 535 clients worldwide in 2021. The company’s influence extends across major tech giants, including Apple, Advanced Micro Devices, Intel, NVIDIA, and more. As of Jan. 30, 2023, TSMC boasts a market capitalization of $429.45 billion, reflecting its monumental role in the tech ecosystem.

Semiconductors: The Beating Heart of Technology

Semiconductors, often colloquially known as microchips, serve as the beating heart of modern technology. These tiny marvels are the building blocks of the devices we rely on daily, from smartphones to medical equipment. Their versatility extends into various industries, impacting healthcare, transportation, communications, and even military systems.

In the fiercely competitive semiconductor business, companies race to design and manufacture chips that define technological progress. TSMC, standing tall among its peers, plays a pivotal role in this ecosystem, crafting the silicon foundations that power innovation.

What is TSMC’s business model? How does TSMC make money?

Taiwan Semiconductor Manufacturing Company (TSMC) has carved a niche as a vital player in the global technology landscape, fundamentally altering the dynamics of semiconductor manufacturing. Understanding how TSMC makes money involves unraveling its unique business model, which distinguishes it from traditional semiconductor companies.

TSMC operates as a “pure-play” foundry, specializing solely in the manufacturing of semiconductor chips without engaging in the design process. Unlike companies like Intel, which both designs and manufactures its chips, TSMC focuses on the intricate process of producing chips based on designs provided by other companies. This distinct approach allows TSMC to cater to a diverse array of clients, ranging from tech giants to emerging startups, making it a linchpin in the semiconductor supply chain.

The company’s revenue streams primarily derive from the sale of semiconductor wafers, each containing multiple individual chips. These chips are meticulously crafted using advanced process technologies, including 3-nanometer, 5-nanometer, and 7-nanometer processes, contributing to TSMC’s leadership in the industry.

TSMC’s business model is characterized by its ability to adapt to the diverse demands of clients across various industries. The company’s clients, known as fabless companies, design chips but outsource their manufacturing to TSMC. This strategic separation of design and manufacturing allows TSMC to efficiently produce high-quality chips for a myriad of applications, including smartphones, automotive electronics, artificial intelligence, and more.

The technological prowess and production capabilities of TSMC have positioned it as a key enabler of innovation for companies worldwide. Apple, for instance, heavily relies on TSMC to manufacture the A-series chips powering iPhones and other devices. TSMC’s role extends beyond just being a manufacturer; it serves as a technological partner, aiding clients in bringing their designs to fruition.

TSMC’s financial success is intricately linked to its ability to stay ahead in semiconductor technology. With a commitment to Moore’s Law—the observation that transistor density on chips doubles approximately every two years—TSMC invests heavily in research and development, ensuring it remains at the forefront of technological advancements. This dedication not only secures its position as an industry leader but also contributes to its revenue growth.

In essence, TSMC’s business model revolves around being the go-to manufacturer for companies seeking cutting-edge semiconductor solutions without the burden of in-house manufacturing. The company’s financial success is a testament to its pivotal role in fueling technological innovation across a myriad of industries, making TSMC a key player in the ever-evolving landscape of semiconductor manufacturing.

Challenges and Innovation

As technology progresses, TSMC, in adherence to Moore’s Law, continues to lead the charge. The company’s diverse technological offerings, ranging from 90nm tech to the development of 5nm and 3nm technologies, showcase its commitment to staying at the forefront of innovation. The post sheds light on the challenges and competition within the semiconductor industry, emphasizing TSMC’s position as a leader.

The Bottom Line

In conclusion, the blog post reflects on the capital-intensive nature of chip manufacturing and how TSMC manages to maintain high-profit margins despite the prohibitive costs. It underscores the company’s pivotal role in shaping the digital landscape and highlights the ongoing advancements and innovations propelling TSMC into the future.

Closing Thoughts

Understanding how TSMC makes money isn’t just about finance; it’s about unraveling the intricate tapestry that underlies our digital world. As we continue to marvel at the technological marvels surrounding us, TSMC’s role becomes increasingly evident. From the tablet in our hands to the intricate components powering our gadgets, TSMC’s influence echoes through the corridors of innovation. Stay tuned to the unfolding chapters of semiconductor evolution, where TSMC continues to shape the digital narrative.

Key Takeaways and Future Outlook

As we journey through the labyrinth of semiconductors, the key takeaways encapsulate the dynamic nature of TSMC’s role—from industry innovation to geopolitical implications. Apple’s significant contribution, North America’s dominance, and TSMC’s global clientele underscore the company’s impact on a worldwide scale.

Looking ahead, TSMC’s commitment to advancing technology is evident. From the current 3nm technology to future endeavors, the company remains dedicated to not just keeping up with technological advancements but pioneering them. As we witness the digital landscape evolving, TSMC’s narrative unfolds, promising a future where microchips continue to shape our world.